SureWay INLIS

SUREWAY INLIS

is an integrated Non-Life Insurance Software Applications designed and

developed based on the local non-life insurance environment. It covers

from the issuance of the policy up to accounting.

Modules

POLICY ISSUANCE AND UNDERWRITING

This underwriting module helps you gather policy information.

Computation of charges and due are automatic. This module are equip

with user definable tables, codes and parameters for easy data inputting.

Underwriting module can generate production registers and summaries.

It can be group by branches and/or by agents. Statistics and Risk Profiles

are also available. Endorsement transactions were provided for changing

policy information and renewal transactions for renewing policies. It

has an inquiry program that helps you see the production totals, current

policy information, and series of endorsements at a glance. Transaction

processing is provided to secure historical and current policies of

unauthorized editing and deleting of policy information. Record backup

was generated when this transaction processing is invoked. Accountable

forms are already being monitored by the system. Including policy, invoice,

official receipt, endorsement, certificate of cover and other liable

forms. This functionality will help in determining which branches or

agencies frequently skip their series for whatever reasons. Number of

spoiled and cancelled documents of branches and agencies are accounted.

Policy distribution is maintained in this module. It can handle proportional

and non-proportional treaties.

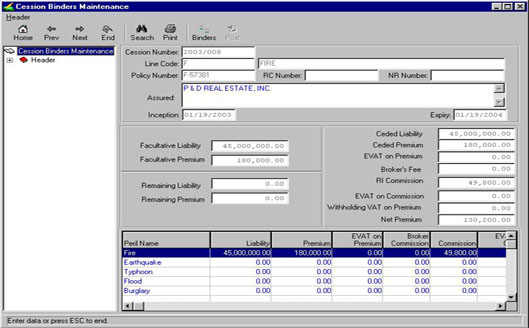

REINSURANCE OUTGOING

This module caters for the facultative distribution

and generation of binders. Automatic computations RI commission and

net premium. Inquiry program for ceded binders, comparative premium

analysis. Reports like register per company, per line and per policy

report layout. Before the expiry of the binder, this module can generate

hold cover report or renewal notices.

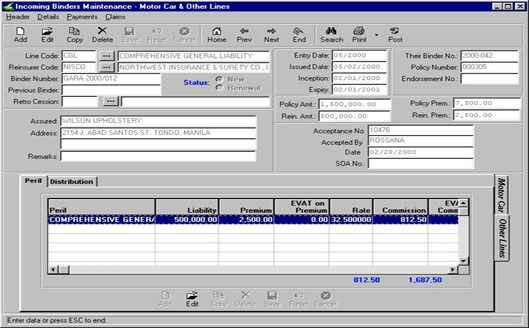

REINSURANCE INCOMING

This module handles the incoming binders/transactions

from other insurance company for all insurance line. It has inquiry

program to check current binder information, production totals, treaty

queries. Statistics per line and registers can be generated.

FIRE BLOCK CARD

Fire Block Card inquiry module refers to the fire risk

exposures per block. It covers the fire direct underwriting transactions

and fire incoming binder transactions. It has a block tagging to group

two or more block (subject to one fire). It monitors block limit and

retention.

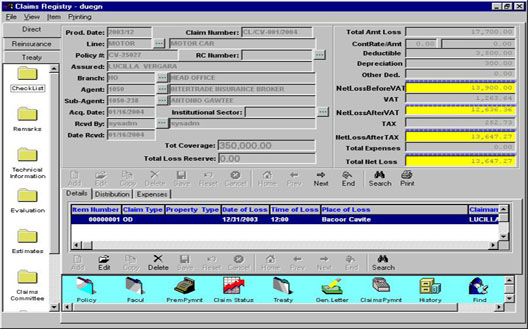

CLAIMS

Claims module tracks the losses transactions and status

of claims. Submission of document and requirements can be monitored.

Adjuster and quotation information is being kept. It can handle multiple

losses per claims transactions. Statistical reports such as loss profile

and loss ratio can be generated. It has built-in workflow functionality

and recovery. Claims status can be viewed in a click of a button.

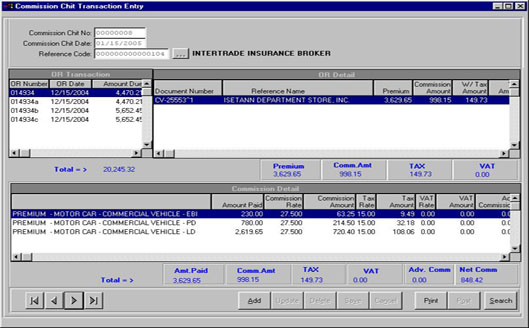

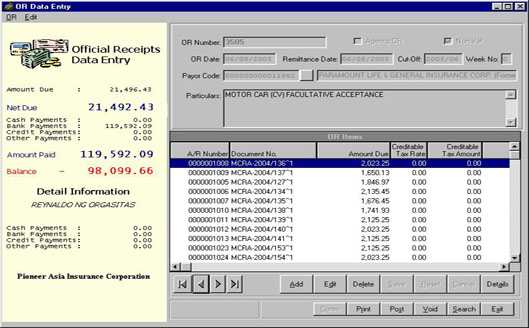

COLLECTION and COMMISSION

This module generates official receipts and agent commissions.

It can also monitor branch or agency remittances. It accepts multiple

official receipts per policy and vice versa. Payments can be cash, checks,

deposit slips and other forms of payment. Over payments can be applied

to the next policy or remittances.

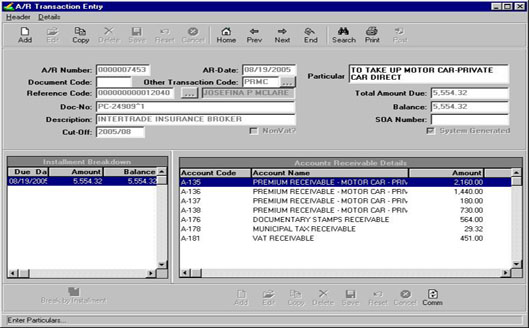

ACCOUNT PAYABLE and RECEIVABLE

Monitor A/P and A/R balances. It can print vouchers,

checks, statements and aging analysis reports.

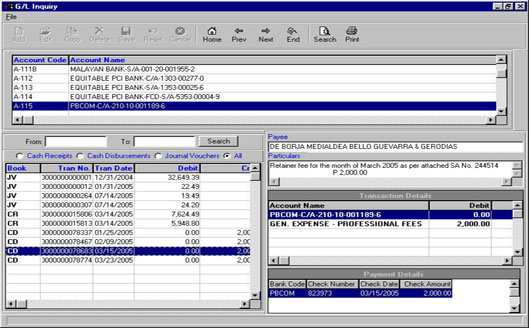

GENERAL LEDGER

Financial reports can be generated in this module.

Chart of Accounts can accommodate unlimited levels. Monitoring of subsidiary

accounts is also part of the GL system. Financial reports are parameterized

and user-definable.

Security Administrator

Data Audit

Access audit

Industry Features

- Integrated Modules

- Quotation and Policy Generation

- Endorsement Transaction Control

- Automatic Policy Renewal and Notices

- Definable Product Lines, Perils and Charges

- Facultative Reinsurance

- Automatic Computation of Premiums and Charges

- Accountable Forms Inventory System

- Expiry and Hold Cover Monitoring

- System Generated Alteration Advices

- Blocking and Zones Limits Validation/Inquiry

- Management and IC Recap Reports

- Proportional and Non-Proportional Treaties

- Branch Limits Control

- Claims Processing and Recovery Workflow

- Claims Status Inquiry and Reports

- Attachment of Photos and Images

- Cashiering and Disbursements

- Statement of Account and Aging

- Non-Premium Related Transactions

- System Generated Accounting Entries

- Parameterized and Definable Financial Reports

- Report Generator and Query Utilities

- Security Administration and Audit Trails

Industry Benifits

- Obtain more reliable and timelier reports to better assist managers

and planners in decision making.

- Establish a more streamlined process to reduce cost of sales and

overhead cost.

- Collect more accurate, more complete customer information and

make of this information to provide better customer service.

- Increase staff efficiency by reducing manual data manipulation.

- Designed that will support your business growth and operations.

|